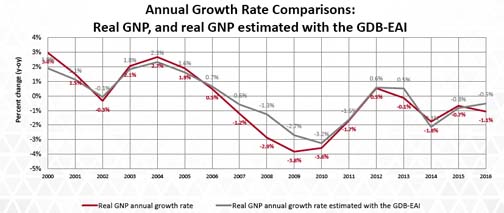

GDB liquidity down 24% in May to $778.8M

The Puerto Rico Government Development Bank released Monday its latest liquidity report showing the agency had $777.8 million left as of May 31, representing a 24 percent drop from the $1.02 billion it had in April.

The agency attributed the decrease in net liquidity to the disbursement of $120 million through the Puerto Rico Treasury Department, $250 million for the repayment of Tax Revenue Anticipation Notes, and $95 million to pay debt service owed by the Puerto Rico Electric Power Authority.

In the latest report, the GDB noted out three upcoming events that “should be considered as part” of its liquidity. By June 30 the agency expects to receive a principal loan payment of $100 million from Treasury, as well as a payment from appropriations of $174 million, while it will realize external debt service payments of some $154 million related to municipal loans.

The agency noted that as of May 30, it had a little more than $72.2 million in cash and bank deposits and $394.5 million in federal funds sold and money market instruments.

It is also holding on to about $855 million in investment securities split between U.S. Treasury and Agency notes and other unspecified securities.

The $777.8 million in net liquidity excludes the $500 million the GDB must set aside for contingencies, this media outlet confirmed.