Hotel room tax collections reach ‘record levels’ in April at almost $7M

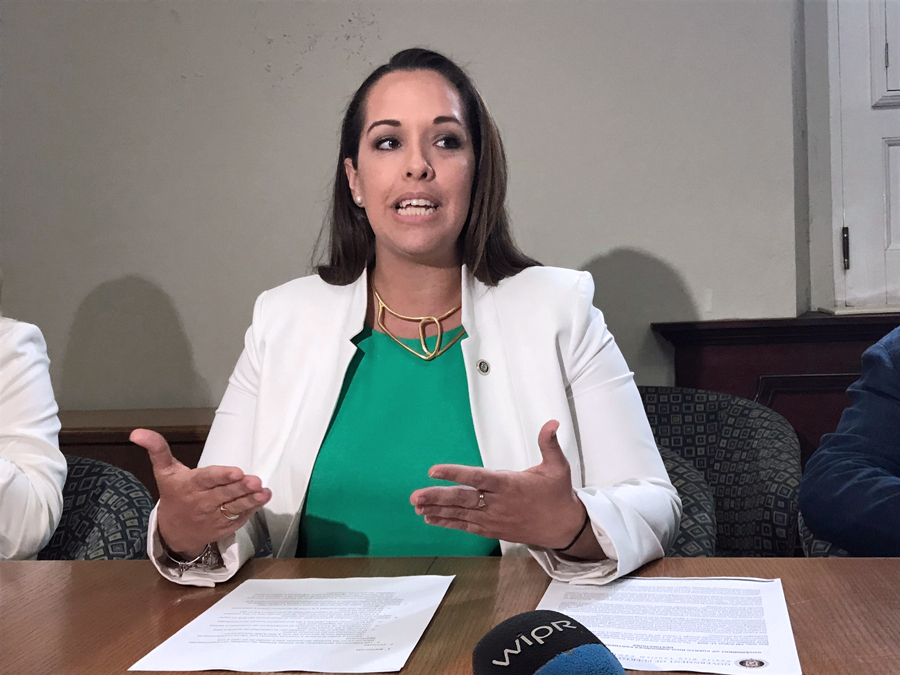

Hotel room tax collections reached nearly $7 million in April, the highest in the history of the levy for that month, Puerto Rico Tourism Company Executive Director Carla Campos said.

In April 2019, collections totaled $6.96 million, a figure that reflects an increase of more than $500,000 when compared to collections for April 2018, and exceeds the record set in April 2015, when room tax collections totaled $6.91 million.

Campos said collections for short-term accommodation have been a factor in the revenue increase. In April 2019, the income derived from short-term accommodation and platforms totaled $1.29 million, representing 18.5% of the total collection, she said.

“We’re reporting historical collections as a result of an increase in the capacity of the government of Puerto Rico to oversee the short-term rental sector and an evident rise in guest registrations in hotels and short-term rentals,” she said.

“If we consider that 12.5% of the bookings in short-term rentals are attributed to local resident stays, and the remaining 87.5% is the product of visitor bookings, it is evident that we’re witnessing a growth in the number of visitors that stay in Puerto Rico and generate a local economic domino effect,” she said.

During the period from July 2018 to April 2019, the government has collected $60.9 million, while for the same period in Fiscal 2017-2018, collections totaled $60.6 million, showing an accumulative improvement, Campos said.

Tourism industry indicators show a growing trend and the government is projecting that more than $73 million in hotel room taxes will be collected in Fiscal 2019. There are more than 2,903 hotels registered in the Tourism Co.’s room tax division and more than 25,000 available rooms.