U.S. House votes to close investor protection loophole

The U.S. House of Representatives voted Monday to close a decades-old loophole that has exempted financial institutions operating in Puerto Rico and the territories from the same investor protections that apply on the mainland.

By a widespread, bipartisan margin, the House approved H.R. 1366, the “U.S. Territories Investor Protection Act.” Introduced by Rep. Nydia M. Velázquez (D-NY) in January, the bill affords the same financial protections to investors in Puerto Rico that have long been benefitted mainland Americans.

“Today, the House acted in the best interest of retirees and individual investors in Puerto Rico,” said Velázquez. “For far too long, Puerto Rican retirees and others have been preyed on by unscrupulous investors who have exploited this disparity in the rules. By passing this measure in the House, we are one step closer to putting an end to these abuses.”

Velázquez’s bill extends the Investment Company Act of 1940 to investment companies operating in Puerto Rico and all U.S. territories. It has been publicly reported that some entities in Puerto Rico have used the current law’s loophole to act both as an underwriter for the issuance of bonds, and then repackaged those same bonds into mutual funds they sold exclusively to investors on the island.

While this type of arrangement is legal in Puerto Rico due to an exemption in the 1940 Company Act, it would be prohibited on the U.S. mainland.

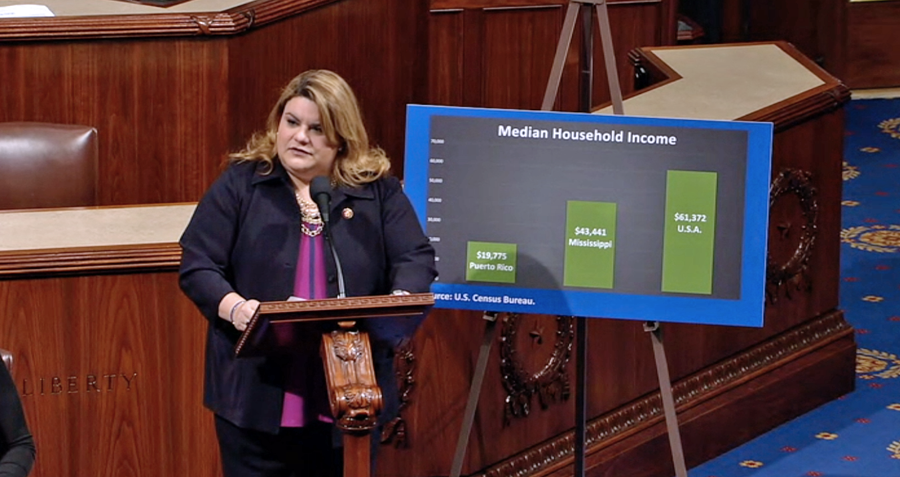

“As a result, investors residing in Puerto Rico and the other territories have experienced investment losses, some of which, likely, would have been prohibited had the 1940 Act applied to the territories,” said Resident Commissioner Jenniffer González Monday.

“For example, UBS operating in Puerto Rico served as an adviser to Puerto Rico’s Employees Retirement System and in 2008 lead the underwriting of a $2.9 billion bond issue for the pension agency,” she said., “UBS then placed $1.7 billion of those bonds into UBS managed mutual funds that UBS then sold exclusively to customers on the island. This investment would have been forbidden by the Investment Company Act, if these UBS funds were sold in the states.”

Puerto Rico’s ongoing debt crisis has worsened the situation. Retail investors holding government bonds have suffered significant losses and are claiming that at least one major investment company did not properly disclose the risks of these funds, due to this conflict of interest exemption.

“Puerto Rican investors holding these bonds have suffered massive losses and are claiming that UBS did not properly disclose the risks of these funds,” González said.

At the time the exemption was created in 1940, it was suggested Puerto Rico and other “U.S. possessions” were physically located too far away for the Investment Act protections to be enforced.

Since then, both Hawaii and Alaska, which are farther away from the mainland than Puerto Rico, have been granted statehood and the protections in the 1940 Act. Additionally, air travel between the U.S. and Puerto Rico is common and many financial instruments are now traded electronically.

“This 1940s era exemption is outdated,” Velázquez said. “Since the adoption of twenty-first century technology and reliance on regular air travel, geography is no longer a barrier. Under this bill, Puerto Rico’s largest investment companies are prohibited from offering products to retirees without the basic safeguards that already protect millions of U.S. investors.”

Velázquez’s legislation, the “U.S. Territories Investor Protection Act,” was twice approved by the House of Representatives last Congress, once as a standalone bill and once as part of a larger package of financial legislation.

In both instances, the measure passed with widespread bipartisan support. However, in the waning days of the last Congress, the bill was blocked in the Senate.

“Today’s bipartisan action in the House is a huge step for the people of Puerto Rico, and I will keep applying pressure for Senate action,” said Velázquez.

Velázquez is the first Puerto Rican woman elected to Congress and the third most senior Democratic Member of the Financial Services Committee. The legislation will now need to be considered by the U.S. Senate.