Momentum builds for and against Ch. 9 inclusion bill

U.S. Congress is still “weighing the merits” of H.R. 870, known as the Puerto Rico Chapter 9 Uniformity Act, as momentum builds from outside groups for and against the measure that would authorize the island’s government to restructure its fiscal obligations under Chapter 9 of the U.S. bankruptcy code.

This week, Luis Fortuño, who served as Puerto Rico’s 10th governor from 2009 to 2013, stepped back into public circles asking Congress to support the bill that is still under review by the U.S. Judiciary Committee.

Since a hearing was held for the bill on Feb. 26, nothing else has come down from Congress on the matter.

“The purpose of our recent hearing on H.R. 870 was to gather information and hear from more stakeholders. We are still weighing the merits of the legislation and so at this point it is too early to comment on next steps,” said a House Judiciary aide on the condition of anonymity.

Fortuño, who is part of the recently established Puerto Rico Financial Stability Coalition (www.stability4PR.com), expressed his support of H.R. 870, known as the Puerto Rico Chapter 9 Uniformity Act, which would pave the way for the island’s public instrumentalities on the brink of financial ruin to obtain a path to recovery under U.S. law.

“From a bankruptcy policy perspective, I do not believe that the current exclusion ever made sense; it certainly doesn’t make any sense now. Puerto Rican bonds are heavily traded in the U.S. municipal bond market, so the legal rules should be the same in Puerto Rico as they are in the 50 states,” he said in an opinion piece he wrote (We don’t have to quote The Hill because it’s on the Coalition’s website as well.)

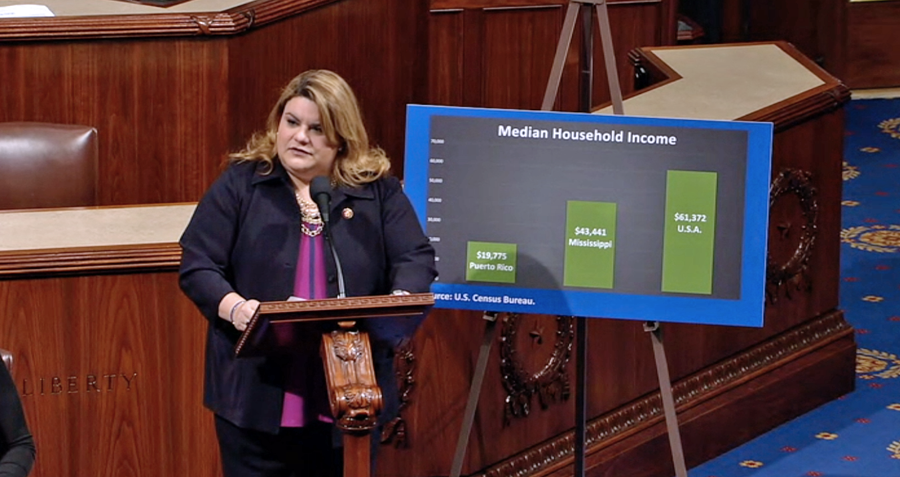

Currently, Puerto Rico is shouldering some $73 billion in debt and the looming possibility of running out of cash by the summer. In recent months, the government has been scrambling to shore up funds, which includes planning a trip to the bond market to borrow $2.95 billion through the Puerto Rico Infrastructure Financing Authority.

The planned new issue has yet to price, and the GDB has yet to officially set a date for the transaction.

Seniors against

On Wednesday, the 60 Plus Association, which describes itself as the “largest right-leaning seniors organization representing more than 7.2 million older Americans,” launched an educational awareness campaign urging Congress to reject the bailout for Puerto Rico.

60 Plus Association took out a full page advertisement that calls Chapter 9 a “bad deal for seniors” and a “bad deal for U.S. taxpayers.”

The advertisement goes on to further state that extending Chapter 9 for Puerto Rico would “unfairly change the rules in the middle of the game for millions of senior citizens and other pensioners and investors who have their life savings on the line.”

“Congress must not ask U.S. taxpayers and retirees to bail out Puerto Rico. It is not only unfair but also unnecessary,” said 60 Plus Chairman and Founder Jim Martin in a release.

“A declaration of bankruptcy would mean significant losses for senior citizens, pensioners and hard-working Americans looking forward to retirement. Instead of rewriting U.S. law to make it easier for Puerto Rico to unilaterally walk away from its debt, Congress should insist Puerto Rico use options it already has to pay its bills and get its financial house in order,” said Martin, adding, “Puerto Rico has options.”

For starters, he said Puerto Rico could negotiate with its bondholders, municipalities, while Puerto Rico Electric Power Authority could take advantage of the fall in oil prices. PREPA’s current debt, estimated at roughly $8 billion, is one of the Puerto Rico government’s biggest fiscal sore spots, along with the Puerto Rico Highway and Transportation Authority.

“Over the long-term, imposition of a control board, similar to the one created for the District of Columbia 20 years ago, could propel governmental reforms and impose fiscal discipline to Puerto Rico that is long-overdue,” he said. “We hope Congress puts the brakes on any plan to saddle American taxpayers and senior citizens with Puerto Rico’s bills and instead moves full-steam ahead on how to impose comprehensive changes in how Puerto Rico is governed and manages its finances.”

Educating Congress

Meanwhile, Resident Commissioner Pedro Pierluisi said he continues to “educate” members of Congress on the merits of the bill.

“In these meetings, I emphasize that the bill simply seeks equal treatment for Puerto Rico under Chapter 9, not special or unique treatment. With my Republican colleagues, I note that the bill costs the federal government nothing and that conservative organizations have traditionally favored Chapter 9 as an alternative to, and way to prevent the need for, an expensive taxpayer-funded bailout,” he said.

Following the Feb. 26 hearing before a subcommittee of the House Judiciary Committee, the next step in the legislative process would be a vote on the bill before the full Judiciary Committee.

“Whether and when to schedule this vote is the prerogative of Rep. Bob Goodlatte, the chairman of the Committee,” Pierluisi said.