Popular launches effort to boost personal loans

With the goal of offering customers a solution to their current financial situation, Popular announced the start of its new personal loans campaign, under the slogan “Consolidate with a personal loan,” expanding on the benefits of this solution.

“We know we’re living challenging times, which is why we’re putting all of our effort so this campaign offers orientation and the customer can conduct an analysis of their situation,” said Patricia Vigoreaux, deputy vice president of marketing at Popular.

The campaign will have presence in radio, national and regional press, television, digital media, among others.

One of Popular’s reasons for promoting debt consolidation is that many people could be paying high interest rates on their credit cards, which are aligned with preferential or prime rates.

That tax rate has registered an increase four times since December 2015. Consequently, if the balance of such cards is high, and the consumer’s economic situation only allows them to make the minimum payment, it could take them many years to pay off their total balance, bank officials said.

“We want our clients to evaluate all of their debts and see consolidation as an instrument to reduce the interest rate they currently pay, and above all, be able to choose the final date to pay them off,” said Solimar Cedeño, vice president of Popular’s Individual Credit Division.

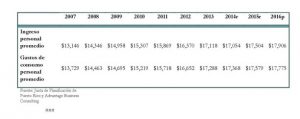

Another element the financial institution took into consideration when defining the focus of its campaign, is the comparison between the consumer’s income and expenses. According to the Planning Board, during six of the 10 years between 2007 and 2016, the average Puerto Rican spent more than they earned.

The analysis of that data shows that even in years when the clients financial behavior was in line with their economic reality, by not exceeding their income, the average difference or residual was less than $160.

“Although consolidation savings depend on a number of factors, our experience indicates that in most cases there is an opportunity that a consumer should not overlook. In some cases the savings could be more than $200,” added Sedeño.

The main call to action of the “Consolidate” campaign is that the consumer can define the period of time in which they wish to pay off their debts and make a single monthly payment adjusted to their financial reality.

Although the interest rate of a loan will be determined based on the customer’s credit history, it can be significantly lower than credit card rates. Furthermore, the interest rate on a loan is fixed and will not changed during the repayment of the loan, executives said.

The financial institution is urging clients to apply for loans to consolidate that, by identifying a source of savings, customers can set aside an amount, however small it may be, to save.

“Credit products allow the consumer to achieve goals and objectives that under other circumstances they may not. Debt consolidation can be the solution to get that financial relief that we are looking for. It is important that once the customer consolidates, they can take control and remain under that new financial reality,” concluded Sedeño.